2025 Q2 Sarasota Housing Market Recap: It’s Not a Crash, But It’s Definitely a Correction

- Jul 25, 2025

- 2 min read

Updated: Sep 9, 2025

Let’s get this out of the way: no, the market hasn’t crashed. But if you’re feeling like things are slower than they used to be, you’re not imagining it. Whether you're a buyer hoping for bargains or a seller clinging to your 2022 Zestimate like it’s a winning lottery ticket, Q2 of 2025 brought a clear message, the Sarasota housing market is cooling… and finally starting to act like a market again.

Here are the numbers for the SINGLE-FAMILY HOME market:

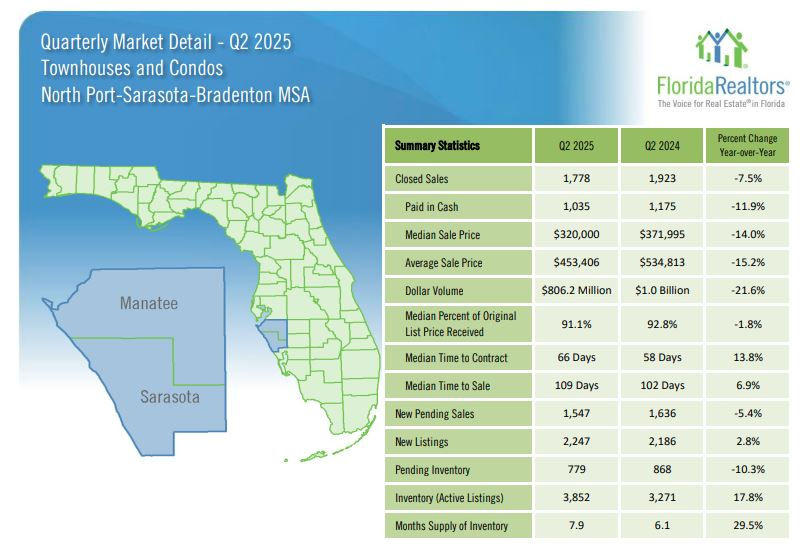

Here are the numbers for the CONDO market:

Prices Are Down — But It’s Not 2008

For single-family homes, the median sale price fell to $460,000, down 12.4% year-over-year. Condos and townhomes? Same tune, different verse, the median price slid to $320,000, a 14% dip from Q2 last year.

But before we call in the doomsday headlines, keep in mind: we’re adjusting from historic highs. This is less a freefall and more like an exhale. The peak pricing party is over and this quarter was the hangover.

Inventory’s Up. Way Up.

Sellers, brace yourselves: inventory levels shot up again. We now have 7,151 active listings for single-family homes (up 25% year-over-year) and 3,852 condo listings (up 17.8%). For context, that’s nearly double what we saw in mid-2023.

The months supply of inventory now sits at 5.7 months for single-family and a buyer-leaning 7.9 months for condos. This isn’t just a shift, it’s a reset.

Translation? Buyers finally have options. Sellers no longer hold all the cards. And yes, that means those record-high list prices with zero updates and 1990s wallpaper are going to sit… and sit… and eventually get a price cut.

Homes Are Taking Longer to Sell

Median time to contract:

Single-family: 54 days (up 12.5%)

Condos/Townhomes: 66 days (up 13.8%)

Gone are the days of “multiple offers by Sunday.” Today’s buyers are cautious, calculated, and willing to wait, especially with higher interest rates and more choices.

Cash Is Still King (But Not as Loud)

In Q2, 34.9% of single-family homes and a whopping 58.2% of condos were paid in cash. Investors are still around, but their grip is loosening. Compared to last year, cash sales are down nearly 10% across the board. That’s a sign the investor frenzy is slowing and financing is starting to play a bigger role again.

Volume Is Dropping

Closed sales are slipping:

Single-family: 4,467 closed (down 2.2% YoY)

Condos: 1,778 closed (down 7.5% YoY)

And even with more listings, new pending sales didn’t rise significantly. That means more homes are sitting on the market, and the absorption rate is slowing.

What Does It All Mean?

This isn’t a market crash, it’s a rebalancing. Prices are correcting from unsustainable highs. Buyers are regaining leverage. Sellers who price ahead of the curve are still selling. Those who try to chase last year’s comps? Not so much.

We're finally seeing a more normal market, one where supply and demand are slowly coming back into alignment.

And honestly? That’s a good thing.

.png)

Comments